The start of the year is financially tough for many people: insurance payments, annual subscriptions, maybe still a few outstanding bills from the holiday season. At the same time, the fridge, freezer, and pantry are often better stocked than at any other time of year.

That’s exactly where the January kitchen experiment comes in: for four weeks, you consistently use up leftovers and pantry staples you already have, dramatically scale back your grocery budget, and then evaluate how much you can actually save.

The analysis below uses fictional but realistic numbers for different household types and shows how a structured “eat down the pantry” routine can work in everyday life.

Many households have similar patterns at the start of the year:

In the budget log, it shows up like this: the grocery budget keeps running as usual, even though the supplies could actually last for weeks.

The experiment follows a clear structure in four steps.

Once a week, ideally on the same day every time, you systematically check the fridge, freezer, and pantry:

Practical trick: Move the “must-use” items to the front or mark them with a small sticker dot. That way, they jump out at you when you cook.

Use the marked foods to create a manageable weekly plan. It doesn’t have to be perfect, but it should roughly define:

It’s enough to plan one main meal per day. Breakfast and snacks can remain flexible, but should preferably be covered from supplies (cereal, bread from the freezer, frozen rolls, etc.).

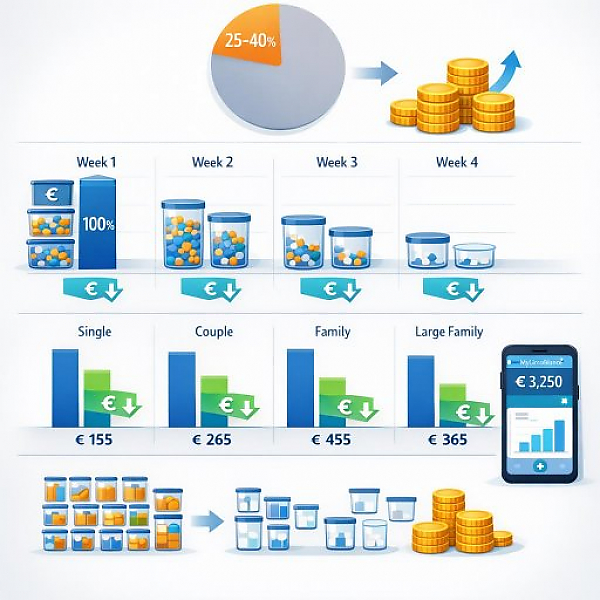

The core of the experiment is a strict but time-limited budget guideline. Example: If a household normally spends 400 euros a month on groceries, only 25 to 40% of that amount is allowed for the four-week leftovers phase.

The exact limit depends on your own supplies:

This limit is entered as a monthly cap in your budget log or app. Every purchase visibly reduces that cap. That keeps the focus clear: use what you have instead of buying more.

To keep leftover-based meals balanced and practical for everyday life, it helps to use a defined basic shopping list. During the experiment, what’s mainly allowed is:

Everything else should come from what you already have as much as possible: pasta, rice, potatoes, frozen vegetables, canned goods, legumes, sauce bases, oil, spices.

The table below shows fictional but plausible average values for a four-week leftovers routine. It compares a “normal” month with a month that strictly focuses on using up supplies. Prices are based on rough averages for Germany, Austria, and Switzerland.

| Household type | Typical monthly grocery budget | Leftovers experiment budget (30%) | Savings in 4 weeks |

|---|---|---|---|

| Single | 220 euros | 65 euros | 155 euros |

| Couple | 380 euros | 115 euros | 265 euros |

| Family with 2 children | 650 euros | 195 euros | 455 euros |

| Shared apartment with 4 people | 520 euros | 155 euros | 365 euros |

In practice, the budget rarely lands exactly at 30%. Many households end up between 30 and 40%. Even then, the effects are substantial:

These amounts stand out clearly in a budget log because most other expenses in January tend to rise or stay steady.

The four-person Keller family (two adults, two elementary-school-age children) starts the year with the following situation:

The budget log makes it clear: in December, grocery costs were 710 euros. So the family plans a four-week leftovers experiment for January.

The first leftovers scan shows just how much has piled up:

The family sets the monthly cap in their budget log at 250 euros (about 38% of the previous budget) and plans the first week:

They only buy fresh vegetables, some fruit, dairy, and eggs. Weekly spend: 55 euros.

The second leftovers scan shows noticeably more space in the freezer. Instead, the open dry staples move into focus: couscous, lentils, bulgur. From those, the minimal weekly plan takes shape:

Now the cart contains only fresh add-ons. Weekly spend: 60 euros. After two weeks, the month’s budget stands at 115 euros out of 250 euros.

The family now leans more on mix-and-match recipes:

The kids get to pick one “wish” item each (e.g., fresh fruit, a yogurt of their choice). That keeps motivation high without blowing the budget. Weekly spend: 45 euros. Running total: 160 euros.

In week four, most of the “old stock” has been used up. What’s left:

That turns into simple meals and baking sessions—pancakes, waffles, or quick pasta dishes. The final weekly shop mainly includes fresh vegetables, milk, and bread. Weekly spend: 70 euros. Monthly total: 230 euros.

Compared with their usual month (650 euros), the Keller family saved 420 euros during the experiment month.

If you apply the example to different household types, the following fictional but plausible savings ranges emerge for a well-prepared four-week period:

In a budget log or app, this is especially helpful because the effect kicks in right when other costs are high. January gets some breathing room—without completely turning daily life upside down.

To make the four weeks workable day to day, a few simple core ideas help. They reduce food waste and add-on purchases at the same time.

At the end of the four weeks, it’s worth taking a quick look at your budget log. Three numbers are enough to make the impact visible:

Optionally, note how full your supplies were before and after the experiment (e.g., a rough percent estimate). If you want, you can put a normal month next to it in February or March and compare whether your shopping habits changed long term.

A four-week “eat down the pantry” routine takes advantage of a time when many kitchens are already well stocked. With a fixed budget framework of 25 to 40% of your usual grocery budget, a weekly leftovers scan, and a basic shopping list, you can significantly cut spending in January.

The fictional averages show that—depending on household type—savings of roughly 150 to 450 euros are realistic without giving up a balanced diet. With clear planning, creative leftover cooking, and consistent tracking in your budget log, full cupboards turn into noticeable financial relief at the start of the year.